Rayce Foster could sense the anxiety in the couple through the computer screen.

A student tax preparer in the University of Georgia Volunteer Income Tax Assistance (VITA) program, Foster listened patiently as the couple explained how they always owed money at the end of the process.

When Foster was finished with their taxes, the couple ended up receiving a refund of more than $1,000.

“Just to see that huge weight taken off their shoulders was really fulfilling to me,” Foster said. “Knowing they don’t have to worry about coming up with money or setting up a payment plan with the IRS — that was so neat.”

Student tax preparers in the UGA VITA program helped Georgia taxpayers file more than 1,500 federal and state tax returns and save about $600,000 in preparation and filing fees this year, through both in-person and remote sessions.

The IRS estimated the statewide economic impact of the services to be more than $4 million.

“Our students and partners showed amazing dedication throughout this process, and we ended up having our best-year ever in terms of aggregate refunds,” said Joan Koonce, a professor and UGA Cooperative Extension financial planning specialist in the College of Family and Consumer Sciences who supervises the virtual sessions. “It was a team effort involving students, faculty, staff and the UGA Extension network all across the state. We’re proud to offer this service and look forward to continued growth.”

UGA has participated in the VITA program for more than 15 years in partnership with Georgia United Credit Union. The program provides free tax preparation assistance to individuals and families with low to moderate income, those with disabilities and the elderly.

Students, both financial planning majors from FACS as well as accounting majors from the Terry College of Business, are certified as tax preparers by the IRS and earn academic credit for their involvement.

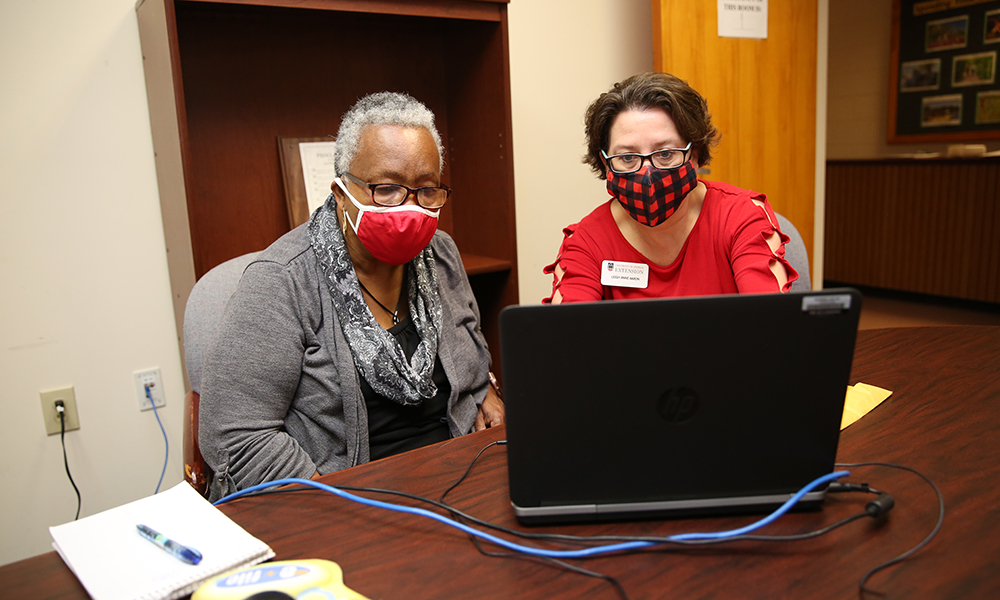

Five years ago, the program expanded to include a virtual component. Virtual VITA allows taxpayers to work with their local UGA Cooperative Extension agent to facilitate remote tax preparation services with students based in Athens.

“Without Georgia United Credit Union, UGA VITA would not be able to serve so many people in the Athens area or have been able to expand the Virtual VITA program,” said Lance Palmer, a professor in the FACS department of financial planning, housing and consumer economics.

This tax season, 130 UGA students participated in VITA, serving 1,614 clients throughout 70 counties in Georgia. Of the 1,500 federal returns filed, 808 were prepared through the virtual channel, the first time in program history returns prepared remotely exceeded in-person returns.

Georgia taxpayers received a total of $2,455,452 in refunds through the program.

“My experience has been really good,” said Hallie Adams, an Oconee County resident who participated in VITA for the first time this year. “Everything is thorough and I get to ask questions. I plan to use it again.”

For students like Foster, who helped Adams and several other clients with tax preparation services, the experience was “integral” to his success. Foster is working part-time for a financial planning firm and plans to attend graduate school in the fall.

“A lot of students might think it’s just plugging in numbers, but there’s a lot more to it than people realize and I think the experience helps students more than they realize,” he said. “I just enjoy talking with the clients and getting to know their experiences — it’s just been very eye-opening for me and I loved every minute of it.”

A comprehensive impact report can be viewed at fcs.uga.edu.

.jpg)