In the news

THE NEW YORK TIMES

SOUTHERN LIVING

THE ATLANTA JOURNAL-CONSTITUTION

-

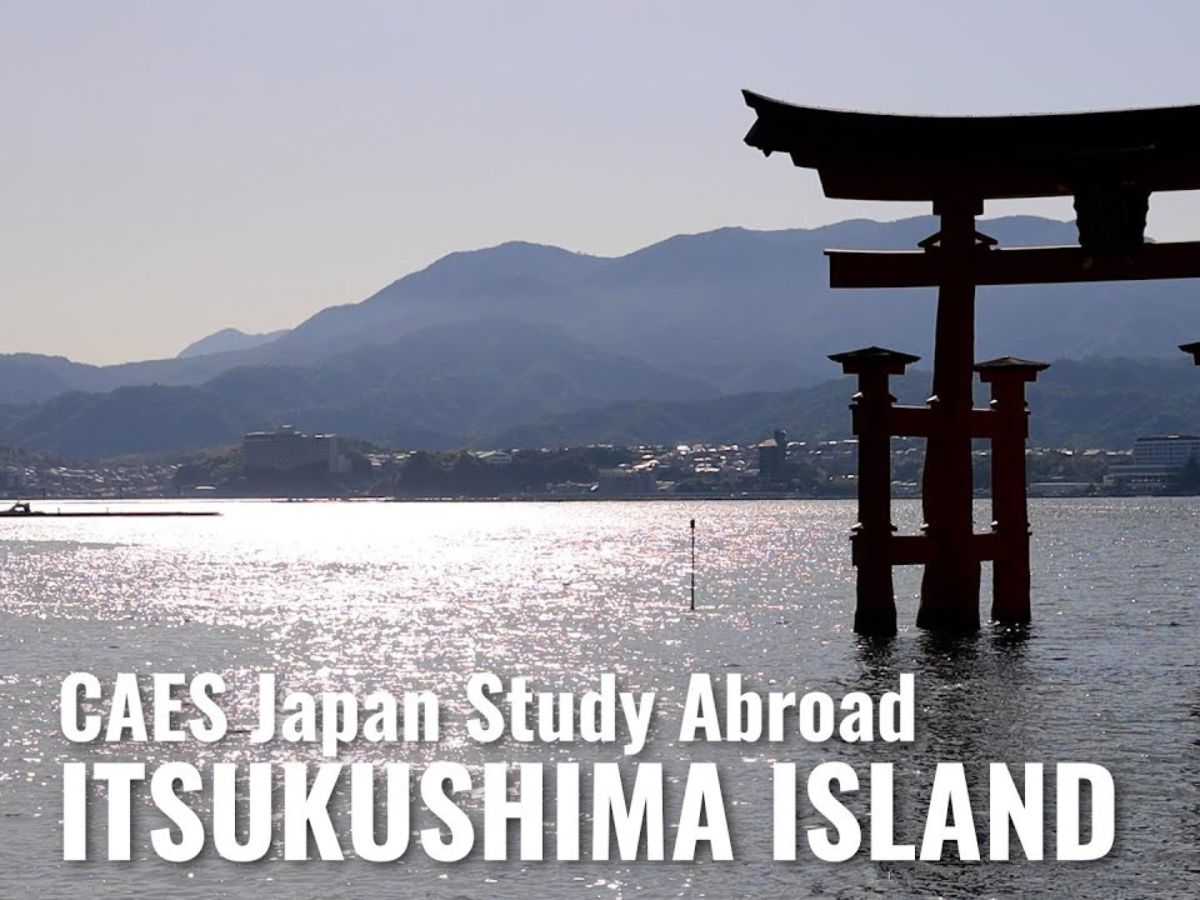

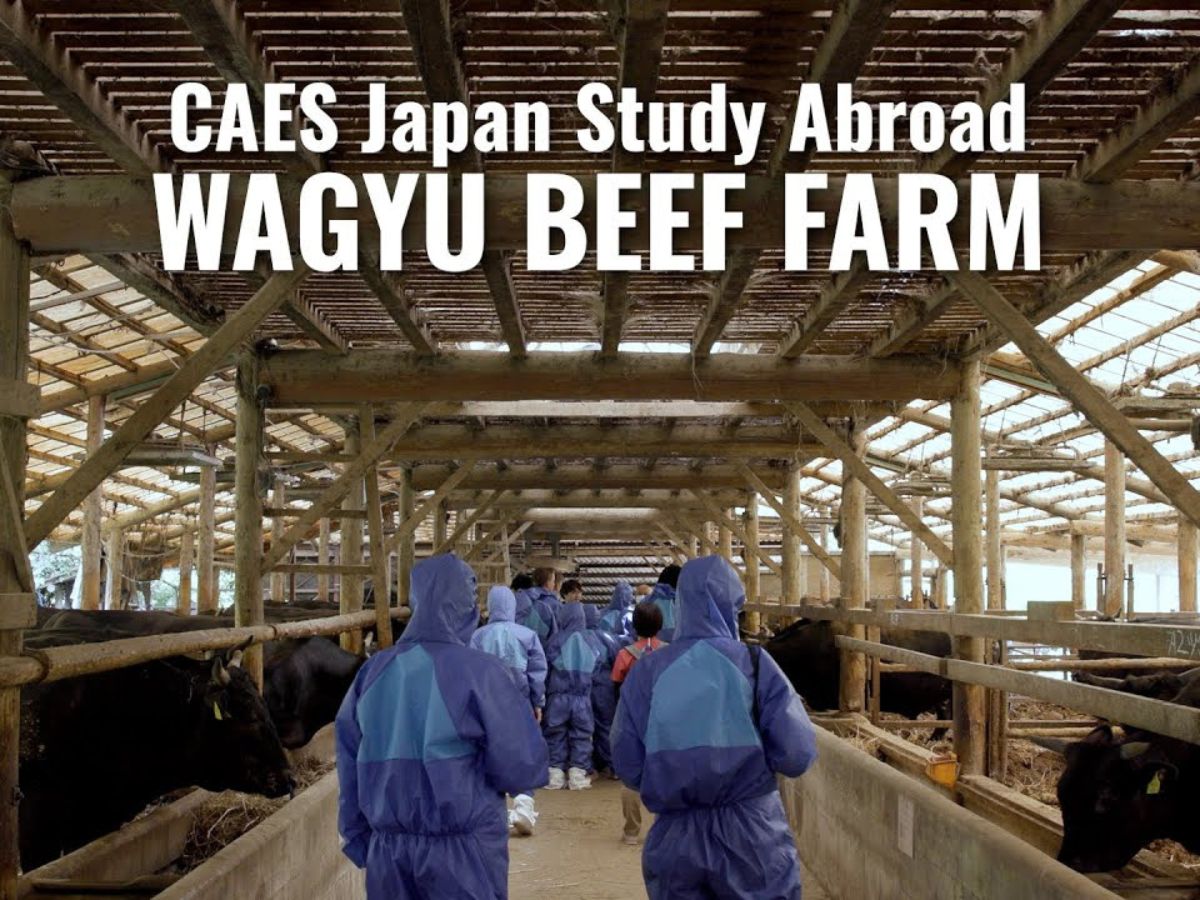

Animal and Dairy Science

Animal and Dairy ScienceCAES students study biosecurity, wagyu beef production during Japan study abroad

Integrative Precision Agriculture

-

Integrative Precision Agriculture

Integrative Precision AgricultureCAES, partners demo future of agriculture at Grand Farm groundbreaking

-

Integrative Precision Agriculture

Integrative Precision AgricultureInvesting in rural America through integrative precision agriculture

-

Integrative Precision Agriculture

Integrative Precision AgricultureVellidis named director of Institute for Integrative Precision Agriculture

Emergency Preparedness

-

Agricultural and Applied Economics

Agricultural and Applied EconomicsFighting fire with fire: How prescribed burns can help mitigate wildfire risks

-

Agricultural and Applied Economics

Agricultural and Applied EconomicsHurricane Helene: Preliminary damage assessment on Georgia agriculture and forestry industry

Expert Resources

Expert resources, also known as UGA Cooperative Extension publications, offer unbiased, research-backed advice to empower Georgians with practical, trustworthy information on agriculture, the environment, food, family and more.

-

Personal Safety

B 1585-01

Three Must-Have Emergency Kits to Pack Before a Hurricane or Flood

As more hurricanes hit the U.S. in unprecedented ways, we need to become better prepared to face the challenges that might arise. Water-related disasters disrupt people’s ability to use and retrieve textiles and clothing items that are necessary to maintain hygiene, stay comfortable, and clean up the aftermath. Hurricane Helene,…